Online Bettors Gearing Up for Biggest NBA Season in Decades

(NewsUSA) - The NBA season tipped off Tuesday, October 18th with no true consensus favorite to take this year’s Championship title. The NBA Championship futures market at BetUS.com shows the Boston Celtics and the Golden State Warriors tied at +600 (6-to-1) odds to win the 2023 Championship, followed closely by the Brooklyn Nets and Los Angeles Clippers, both of which are paying +700 (7-to-1). The Milwaukee Bucks round out the top five, paying +800, or 8-to-1. These odds will change as the season progresses, however.

- The NBA season tipped off Tuesday, October 18th with no true consensus favorite to take this year’s Championship title. The NBA Championship futures market at BetUS.com shows the Boston Celtics and the Golden State Warriors tied at +600 (6-to-1) odds to win the 2023 Championship, followed closely by the Brooklyn Nets and Los Angeles Clippers, both of which are paying +700 (7-to-1). The Milwaukee Bucks round out the top five, paying +800, or 8-to-1. These odds will change as the season progresses, however.

An offseason full of big trades has resulted in what ESPN’s well-known sports betting analyst, David Purdum, is predicting to be “one of the most competitive NBA seasons in decades.”

This means that both bookmakers and bettors are hard at work gauging this season’s teams. And for those bettors willing to put some money down on their team early in the season, it means higher returns than would be available as the season progresses, according to Barry Barger, senior betting analyst at BetUS.

“Futures markets in sports betting are betting lines that are offered on events that are set to occur sometime away, as opposed to the next game on a team’s schedule. Once the bettor has placed a bet on his/her odds of choice, they have locked in their bet at the odds provided at that time and will be paid out at that rate should their wager be a winner when the event occurs,” Barger says.

“The big advantage to betting your team to win the Championship now, versus ‘waiting to see how things go’ during the season is that right now, you can bet any of the 30 teams in the NBA to win the Championship at what we call ‘plus money,’ or positive odds.

For example, even this season’s favorites like the Boston Celtics and the Golden State Warriors will pay +600, or 6-to-1, if you bet them now to win the Championship. No matter what team you bet, you’re going to win multiples of your original stake if your team wins it all this year,” Barger says. “That won’t be the case as the season progresses.”

But betting the future 2023 Champion isn’t the only future or ‘prop’ that is popular with NBA bettors these days.

NBA futures allow you to bet not only on the NBA Championship, but also on who will win the Eastern or Western Conferences and even the division champions. Betting on the number of regular season wins a particular team will have is also a popular wager.

“And unique to this year, the prop that has fans really excited is when -- and where -- Lebron James will break Karim Abdul-Jabbar’s all-time scoring record,” Barger adds.

Other popular NBA futures and props include betting odds on NBA Rookie of the Year, NBA Coach of the Year, NBA Defensive Player of the Year and NBA Regular Season MVP to name a few.

In short, the appeal of future bets is that they offer potentially larger returns and provide a longer time horizon over which your bet will win or lose, providing more entertainment value while you cheer on your pick or picks over the course of the season, Barger concludes.

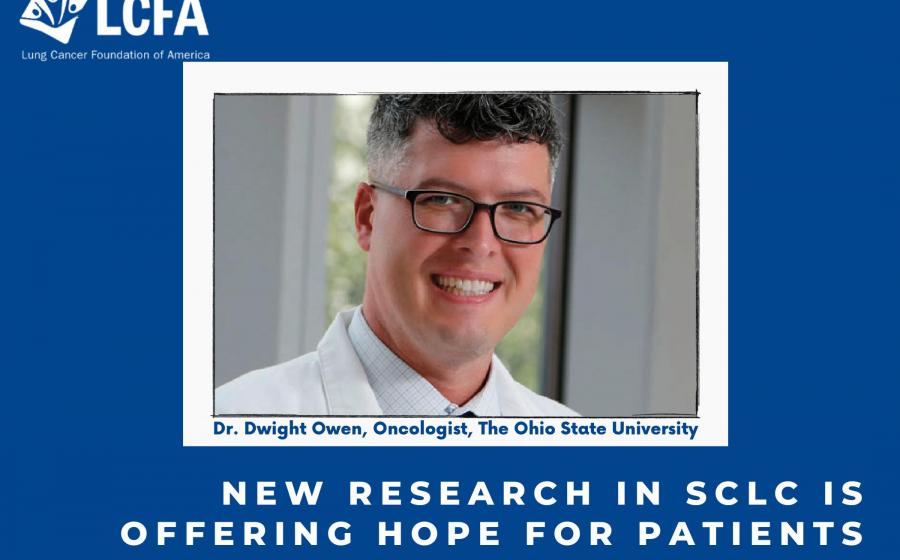

- New research in the treatment of small cell lung cancer offers hope to patients.

- New research in the treatment of small cell lung cancer offers hope to patients.

- Many adults today are juggling the demands of work, household upkeep, finances and school-aged children, while also caring for an aging parent. This group, known as the sandwich generation, may feel more like a panini -- pressed and grilled between the weight of their caregiving duties. According to a

- Many adults today are juggling the demands of work, household upkeep, finances and school-aged children, while also caring for an aging parent. This group, known as the sandwich generation, may feel more like a panini -- pressed and grilled between the weight of their caregiving duties. According to a

- The Medicare Advantage and Prescription Drug Plan Annual Election Period is underway, running from Oct. 15 through Dec. 7. Whether you are new to Medicare or are re-evaluating your options for a health care plan, navigating the abundance of choices can feel overwhelming. This is especially true for Veterans who also may be covered by other government-sponsored benefits, like those offered by Department of Veterans Affairs (VA), depending on their time in service and disability rating. With there being so many options to choose from, the biggest challenge is often knowing where to begin.

- The Medicare Advantage and Prescription Drug Plan Annual Election Period is underway, running from Oct. 15 through Dec. 7. Whether you are new to Medicare or are re-evaluating your options for a health care plan, navigating the abundance of choices can feel overwhelming. This is especially true for Veterans who also may be covered by other government-sponsored benefits, like those offered by Department of Veterans Affairs (VA), depending on their time in service and disability rating. With there being so many options to choose from, the biggest challenge is often knowing where to begin.  -

-  “A Spying Eye”

“A Spying Eye” “Dear Franklin”

“Dear Franklin”  “A Very Long Way”

“A Very Long Way”  “Can You Spot the Leopard: An African Safari”

“Can You Spot the Leopard: An African Safari”

- There’s a new generation running the show in the Kidverse: Generation Alpha. Defined as those born between 2010 and 2024, this new group of kiddos succeeding Generation Z is more diverse than any other generation, far more technologically savvy at a younger age and only know a world where social media is at the center of everything -- thus making social media stars THE celebrities they care about.

- There’s a new generation running the show in the Kidverse: Generation Alpha. Defined as those born between 2010 and 2024, this new group of kiddos succeeding Generation Z is more diverse than any other generation, far more technologically savvy at a younger age and only know a world where social media is at the center of everything -- thus making social media stars THE celebrities they care about.

- For Julie Lycksell, a wife, a mother and retired operating room nurse from Long Island, NY, Feb. 6, 1998, is a date she will never forget. On that day, only two days after her actual birthday, Julie celebrates her “re-birthday” -- marking the day she nearly died from sudden cardiac arrest (SCA).

- For Julie Lycksell, a wife, a mother and retired operating room nurse from Long Island, NY, Feb. 6, 1998, is a date she will never forget. On that day, only two days after her actual birthday, Julie celebrates her “re-birthday” -- marking the day she nearly died from sudden cardiac arrest (SCA).  -

-  “Rich Widows of Savannah Valley”

“Rich Widows of Savannah Valley” “I’ll Remember You”

“I’ll Remember You” “Jasper the Wonder Dog”

“Jasper the Wonder Dog” “Aha! So That’s What Bitcoin Is!”

“Aha! So That’s What Bitcoin Is!”

- Many Native American children living on remote Reservations in the United States are growing up in unimaginable poverty, and their struggles are magnified by current skyrocketing prices for gas and food. Unemployment on Reservations is high, and jobs for many parents are scarce. Multigenerational families often share small houses, many of which lack phones, running water and sometimes even electricity. When families are struggling to pay for the necessities, there is no budget for Christmas presents. That’s where Marine Toys for Tots stands ready to assist children living on remote Reservations -- and that’s where you can help, too.

- Many Native American children living on remote Reservations in the United States are growing up in unimaginable poverty, and their struggles are magnified by current skyrocketing prices for gas and food. Unemployment on Reservations is high, and jobs for many parents are scarce. Multigenerational families often share small houses, many of which lack phones, running water and sometimes even electricity. When families are struggling to pay for the necessities, there is no budget for Christmas presents. That’s where Marine Toys for Tots stands ready to assist children living on remote Reservations -- and that’s where you can help, too.

- It’s an age-old question -- to feed or not to feed birds in fall and winter. Some people believe that feeding wild birds can cause more harm than good, like preventing timely migrations, or causing birds to depend on feeders rather than foraging food. The truth is these are myths and feeding birds is beneficial to their well-being. Birds migrate regardless of seed in feeders. It’s estimated that wild birds only get 25 percent of food from feeders, the rest is naturally sourced, so full feeders don’t keep birds from migrating. Instead, several triggers urge birds to migrate: like changes in nesting locations as trees lose leaves, less natural foods, insect decline, winds, temperature drop and day length. As days grow shorter, many birds get internally restless and head south, taking advantage of plentiful natural foods, and stocked feeders to fuel their flight.

- It’s an age-old question -- to feed or not to feed birds in fall and winter. Some people believe that feeding wild birds can cause more harm than good, like preventing timely migrations, or causing birds to depend on feeders rather than foraging food. The truth is these are myths and feeding birds is beneficial to their well-being. Birds migrate regardless of seed in feeders. It’s estimated that wild birds only get 25 percent of food from feeders, the rest is naturally sourced, so full feeders don’t keep birds from migrating. Instead, several triggers urge birds to migrate: like changes in nesting locations as trees lose leaves, less natural foods, insect decline, winds, temperature drop and day length. As days grow shorter, many birds get internally restless and head south, taking advantage of plentiful natural foods, and stocked feeders to fuel their flight.